For several years, the retail industry has faced stagnant growth, with compound annual rates between 1.5 and 3.5 percent across segments. At the same time, margins continue shrinking as customer expectations rise around availability, speed, and omnichannel consistency.

You feel this pressure in daily decisions across teams. Inventory often misses demand signals, while sales teams push targets disconnected from stock realities. These gaps create friction, missed revenue, and constant firefighting across functions.

In this blog, we’ll explore how retailers can use OKRs for inventory & sales goal alignment, showing how leadership sets shared objectives, teams track outcomes, and execution stays focused across departments.

Key Takeaways:

- OKRs connect inventory and sales when leadership defines shared outcomes tied to business results.

- Joint ownership and shared reviews reduce conflict between inventory risk and sales demand.

- Outcome-based OKRs replace siloed KPIs and surface issues earlier in the quarter.

- Weekly reviews keep goals visible and prevent late-stage surprises.

- Fewer objectives help your teams focus on revenue results and stock health.

How OKRs Support Retail Growth Beyond Daily Store Operations

OKRs matter because retail growth problems rarely stay inside stores. You manage competing priorities across sales, inventory, and operations, while leadership lacks a single view of progress and tradeoffs.

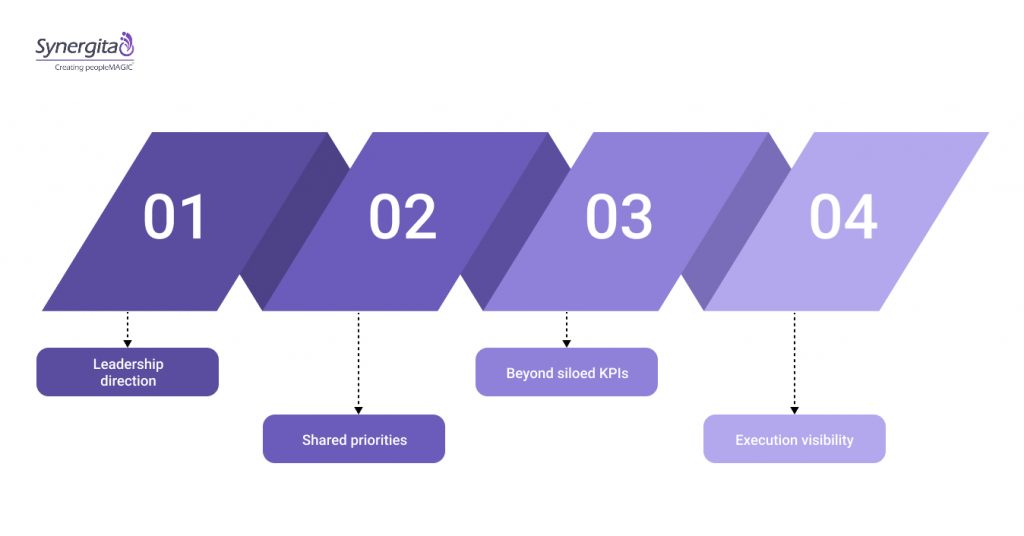

This leadership gap explains why OKRs work beyond store operations and replace fragmented goal-setting across the organization.

- Leadership direction: OKRs help executives define outcomes that guide decisions across sales planning, inventory investment, and operational focus.

- Shared priorities: Sales, inventory, and operations commit to the same objectives, reducing friction caused by conflicting targets and disconnected planning cycles.

- Beyond siloed KPIs: KPIs measure isolated activity, while OKRs connect outcomes across teams under common objectives that leadership reviews together.

- Execution visibility: Regular OKR reviews surface risks early, keeping priorities visible and decisions grounded in shared progress signals.

With leadership focus in place, the real test lies in reducing tension between demand goals and stock control decisions.

Also Read: Why Are OKRs Important for Business Success? 12 Practical Reasons That Prove It

How OKRs Align Inventory and Sales Goals

Inventory and sales goals often collide because each team measures success differently. Sales push demand, while inventory controls risk, leaving leaders to reconcile conflicting signals after results slip.

OKRs address this conflict by creating shared outcomes that both teams own, measured through results that reflect demand, availability, and revenue together.

- Shared objectives: Sales and inventory commit to the same objective, forcing joint planning around demand targets and stock decisions.

- Outcome-based results: Key Results focus on sell-through, availability, and revenue impact, rather than isolated activity inside one function.

- Joint ownership: Both teams review progress together, reducing finger-pointing and encouraging coordinated course corrections during the quarter.

- Clear tradeoffs: OKRs make stock investment decisions visible, helping leaders balance growth targets against inventory risk with clarity.

This relationship only holds when OKRs follow a clear setup process that guides teams from objectives to weekly reviews.

Also Read: How Can Performance Management Software Boost Revenue Growth?

Step-by-Step: How Retail Leaders Should Set Inventory & Sales OKRs

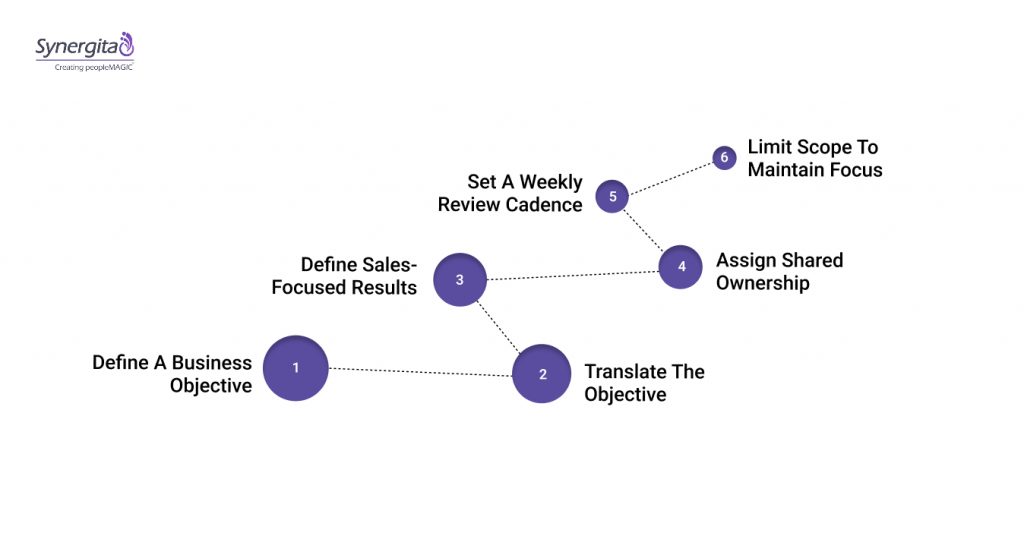

Retail leaders need a clear sequence when setting OKRs, because inventory and sales goals fail when defined independently or handed down without shared context.

The process starts at the top, then moves deliberately through teams, measures, and review rhythms to keep goals connected throughout the quarter.

Step 1: Define a Business Objective That Reflects Growth Reality

Start with one objective that reflects revenue pressure, margin constraints, and stock risk across the business. This objective must describe an outcome leadership cares about, not a task list or departmental wish.

Step 2: Translate the Objective Into Inventory-Focused Results

Inventory results should reflect demand responsiveness and capital discipline, not warehouse activity alone. These results give sales teams confidence that availability supports targets without creating excess exposure.

- Stock availability: Measure in-stock performance across priority categories tied directly to revenue contribution.

- Sell-through: Track how quickly inventory converts to sales within the quarter.

- Stock risk: Monitor excess or aging inventory that threatens margin or cash flow.

Step 3: Define Sales-Focused Results That Reflect Supply Reality

Sales results must acknowledge inventory constraints, not assume unlimited availability. This prevents aggressive targets that force reactive buying or markdown pressure later.

- Revenue contribution: Measure revenue tied to available and prioritized inventory, not total aspirational demand.

- Forecast accuracy: Track how closely sales projections match actual sell-through trends.

- Channel focus: Measure sales mix across stores and channels based on stock position.

Step 4: Assign Shared Ownership Across Teams

Inventory and sales leaders must jointly own the same objective, reviewed in the same forums. This structure removes excuses and forces coordinated decisions when results drift off track.

Step 5: Set a Weekly Review Cadence

Weekly reviews keep progress visible and prevent late-quarter surprises. These sessions focus on results movement, not explanations, and prompt fast course correction when signals change.

Step 6: Limit Scope to Maintain Focus

Resist adding extra objectives during the quarter. Fewer objectives keep attention on results that matter most to revenue, stock health, and leadership decision-making.

To move from theory to action, examples clarify how retail teams write OKRs that guide daily decisions.

Also Read: 5 Steps Action Plan to Roll Out OKR in Your Organization

Practical OKR Examples for Inventory & Sales Alignment

Clear examples help leaders see how OKRs connect inventory and sales without confusion. These OKR examples show how objectives and results work together across levels, using simple language that teams can review weekly.

Company-Level OKR Examples

Example 1

- Objective: Improve quarterly revenue reliability while keeping inventory exposure within approved limits.

- Key Result 1: Increase sell-through across priority categories by fifteen percent within the quarter.

- Key Result 2: Reduce excess inventory value by ten percent without increasing stockout incidents.

- Key Result 3: Keep revenue forecast variance within five percent by quarter end.

Example 2

- Objective: Balance revenue growth with disciplined inventory investment across channels.

- Key Result 1: Achieve planned revenue targets using existing inventory for at least eighty percent of sales.

- Key Result 2: Limit end-of-quarter aged inventory growth to under six percent.

- Key Result 3: Improve weekly demand forecast accuracy across top categories.

Inventory Team OKR Examples

Example 1

- Objective: Maintain stock readiness for revenue-driving categories throughout the quarter.

- Key Result 1: Keep in-stock levels above ninety-five percent for top revenue SKUs.

- Key Result 2: Reduce inventory older than ninety days by twelve percent.

- Key Result 3: Update replenishment plans weekly using actual sell-through data.

Example 2

- Objective: Control inventory exposure while supporting planned sales volumes.

- Key Result 1: Limit emergency replenishment requests to fewer than three per category.

- Key Result 2: Reduce markdown-driven inventory clearance by eight percent.

- Key Result 3: Maintain weeks-of-supply targets across priority categories.

Sales Team OKR Examples

Example 1

- Objective: Deliver quarterly revenue targets using prioritized inventory across stores and channels.

- Key Result 1: Achieve revenue targets without exceeding approved stock availability thresholds.

- Key Result 2: Improve weekly forecast accuracy by reducing variance against actual sales.

- Key Result 3: Increase sales contribution from high-availability categories.

Example 2

- Objective: Drive predictable sales performance supported by inventory plans.

- Key Result 1: Meet category-level revenue targets tied to confirmed stock positions.

- Key Result 2: Reduce lost sales caused by stock gaps by ten percent.

- Key Result 3: Shift promotional focus toward categories with stable availability.

Shared Cross-Functional OKR Examples

Example 1

- Objective: Deliver consistent revenue results without increasing stock risk during the quarter.

- Key Result 1: Conduct weekly joint reviews covering sell-through, availability, and revenue movement.

- Key Result 2: Resolve demand and stock gaps within one review cycle.

- Key Result 3: End the quarter with excess inventory growth below five percent.

Example 2

- Objective: Maintain balance between demand generation and inventory discipline across channels.

- Key Result 1: Align weekly sales plans with confirmed inventory positions before execution.

- Key Result 2: Reduce late-quarter inventory surprises through shared demand reviews.

- Key Result 3: Close the quarter with planned revenue and controlled stock levels.

Understanding what works also requires recognizing where teams go wrong when OKRs replace familiar goal systems.

Also Read: Essential OKR Dashboard Examples for Goal Tracking

Common OKR Mistakes Retail Leaders Make

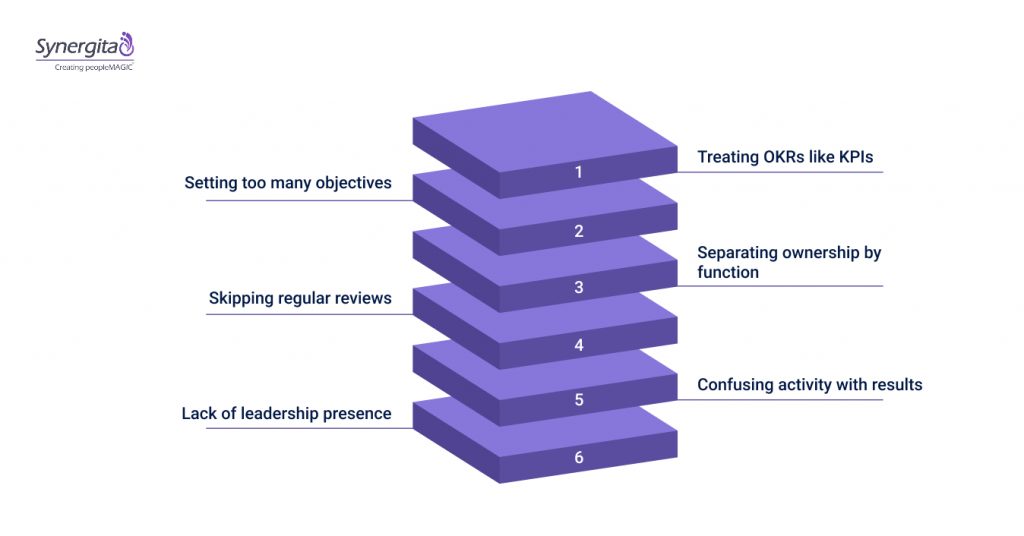

Retail leaders often adopt OKRs with good intent, yet execution breaks down when habits from traditional goal-setting carry over unchanged. These mistakes weaken focus, create confusion across teams, and limit progress during the quarter.

Here are the most common OKR mistakes retail leaders make when connecting inventory and sales goals.

- Treating OKRs like KPIs: Leaders reuse existing metrics without reframing outcomes, turning OKRs into static scorecards instead of shared decision guides.

- Setting too many objectives: Excess objectives dilute attention, forcing teams to juggle priorities and delaying action when inventory or sales signals shift.

- Separating ownership by function: Assigning inventory OKRs to one team and sales OKRs to another recreates silos and fuels conflict during reviews.

- Skipping regular reviews: Quarterly-only check-ins delay corrective action, leaving stock imbalances and revenue gaps unaddressed until it is too late.

- Confusing activity with results: Teams report tasks completed rather than measurable changes in sell-through, availability, or revenue performance.

- Lack of leadership presence: When executives delegate reviews, OKRs lose authority and teams revert to local priorities under pressure.

Avoiding these mistakes becomes easier when leaders follow a few consistent practices throughout the quarter.

Also Read: Top 10 OKR Mistakes and How to Avoid Them

Best Practices to Keep Inventory & Sales OKRs on Track

Keeping OKRs on track requires consistent habits, visible leadership involvement, and shared review rhythms that connect inventory signals with sales outcomes throughout the quarter.

Here are proven best practices retail leaders use to keep inventory and sales OKRs moving in the right direction.

- Weekly review rhythm: Hold fixed weekly reviews where sales and inventory leaders assess result movement, surface risks early, and agree on next actions together.

- Single source of truth: Use one shared dashboard for sell-through, availability, and revenue data, so teams discuss facts rather than conflicting reports.

- Leadership presence: Executive participation in reviews reinforces priority, resolves tradeoffs quickly, and prevents teams from reverting to local targets.

- Outcome-first discussions: Focus conversations on result movement instead of completed tasks, ensuring meetings drive decisions rather than status updates.

- Limited objective count: Keep objectives few per quarter so attention stays on revenue impact and stock health rather than scattered initiatives.

- Tool-supported visibility: Platforms like Syenergita help teams track progress, review results together, and maintain consistency without manual follow-ups.

With the right habits in place, OKRs support clearer decisions and steadier progress across inventory and sales teams.

Conclusion

Inventory and sales results improve when leaders stop treating goals as separate exercises and start managing outcomes together through shared objectives. This is exactly how retailers can use OKRs for inventory & sales goal alignment, connecting demand planning, stock decisions, and revenue targets across teams without creating friction.

When supported by consistent reviews and clear ownership, OKRs move discussions away from blame and toward measurable progress. Platforms like Synergita support this approach by giving leaders visibility into goals, results, and shared accountability in one place.

Start your free trial and turn misalignment into clarity.

FAQs

1. How many OKRs should retail leaders set each quarter?

Most leadership teams should limit themselves to one or two objectives per quarter. More than that reduces focus and weakens decision clarity when inventory and sales signals conflict.

2. How long does it take to see results after introducing OKRs?

Most retailers notice clearer conversations within weeks. Measurable changes in stock health or sales predictability usually appear by the second or third review cycle.

3. Should store managers have their own OKRs or only follow leadership goals?

Store managers should own OKRs that connect directly to company objectives. This keeps execution grounded while avoiding local goals that drift away from revenue or stock priorities.

4. Can OKRs work alongside existing incentive or bonus structures?

Yes, but incentives should not map one-to-one with OKRs. OKRs guide focus and decisions, while incentives reward overall contribution and behavior across the quarter.

5. What data sources should teams rely on during OKR reviews?

Teams should agree on a small set of trusted reports before the quarter starts. Consistent data sources prevent debates over numbers and keep reviews focused on decisions.